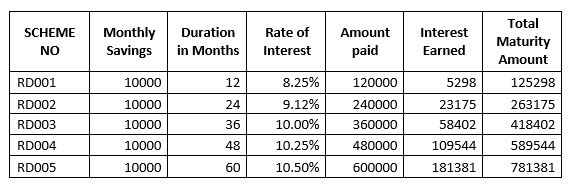

Recurring deposit account is opened by those who want to save regularly for a certain period of time and earn a higher interest rate. In recurring deposit account Minimum amount Rs.1000/- and multiplies of 500/- is accepted every month for a specified period (1year to five year) and the total amount is repaid with interest at the end of the particular period.